A mounting sense of urgency around the challenges facing the food system is helping to soften consumer resistance to science and technology in food, said Shelley Balanko, Ph.D., Senior Vice President, The Hartman Group, at the 2023 Clean Label Conference. Her presentation “Food and Technology: Consumer Trends & Tensions” was based on findings from The Hartman Group’s “Food & Technology Study 2023.”

Traditionally, while consumers have accepted and even embraced many scientific and technological innovations in their food lives, they remain most guarded regarding what they put in their bodies. Consumers evaluate novel food production methods through interrelated, overlapping criteria that reflect deep-seated concerns about the impacts of science and technology on (and in) food, noted Balanko. How these tensions play out at the shelf will ultimately depend on how these production methods are embodied in real-world products and categories.

The Hartman Group first researched consumer sentiment and food technology in 2019. Since then, challenges in our food system are pushing consumers toward considering science and technology as the best path forward,” explained Balanko.

Food System Challenges

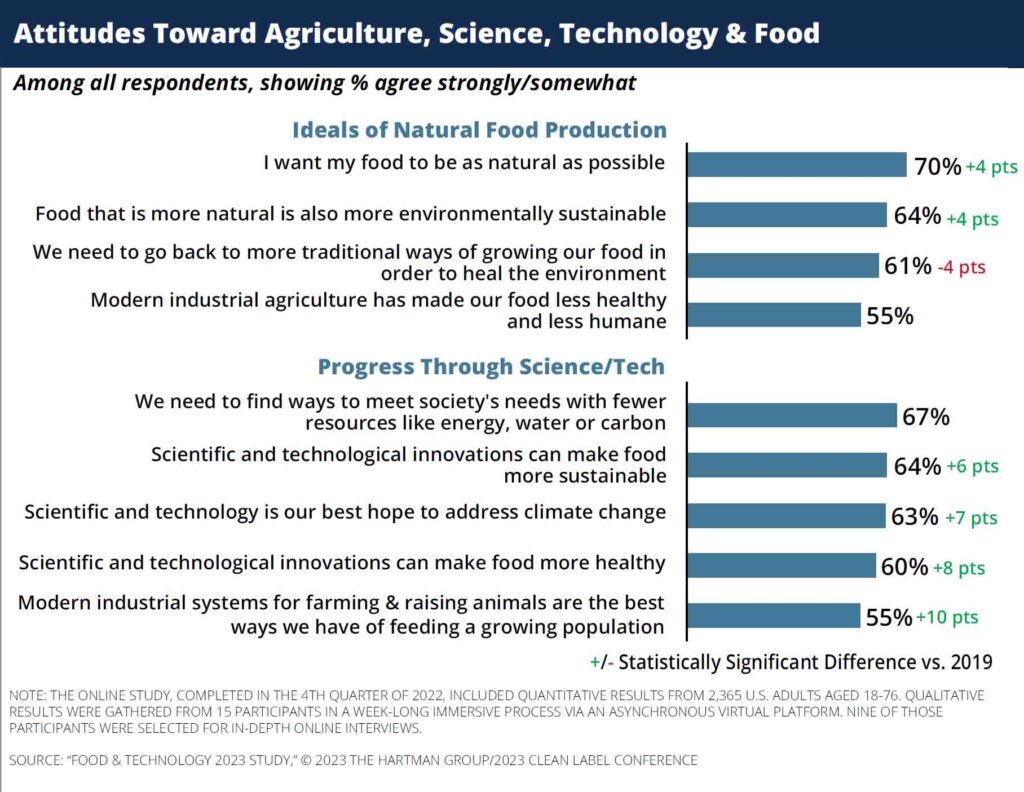

Challenges around our food system include sustainability, such as climate change or reducing resources, like energy, water or carbon; food security—defined as population growth; ethics or animal welfare (including the possibility of removing animals entirely from the food supply); and health and well-being. These challenges are softening consumers’ resistance to science and technology in food. Consumers are endorsing both a natural narrative and a science/technology narrative. (See chart above “Attitudes toward Agriculture, Science Technology and Food.”)

In Hartman’s “Food & Technology Study 2023,” respondents were asked about their awareness, motivations, and barriers to trial (i.e., a consumer’s first usage experience with a product, service, or, in this case, a technology) of 11 food technologies. They were regenerative agriculture, hydroponic farming, plant-based proteins, biomass fermentation, precision fermentation, GMOs, cultured meat, cellular dairy, cell-based seafood, nutrient fortification using nanotechnology, and AI-driven food science/production.

Consumers showed more familiarity with established production methods and agricultural/land connections, such as plant-based proteins, GMOs, hydroponic farming and regenerative agriculture. Interestingly, cultured meat ranked among the top five in terms of familiarity because of mainstream media coverage.

“Qualitatively speaking, consumers stressed that trial is very different from adoption. It will take much more to bring (certain technologies) into their cultural repertoires,” emphasized Balanko. Taste will be primary, as are health and wellness, ethics and experience. While many food technology companies are leading with ethics-related benefits, she noted that health-related benefits are the strongest purchase drivers.

Plant-Based, Cellular Ag & GMOs

The global plant-based market is projected to reach $162 billion by 2030. Plant-based protein motivators included health, low price, ease of preparation, environmental benefits and improving animal welfare.

Consumers tend to be more experimental with prepared foods vs. making foods from scratch. The Boomer generation is more critical of plant-based foods, because producers of products such as the Impossible Burger and Beyond Meat focused on processing at the expense of health and nutrition. As a result, consumers began scrutinizing ingredient statements more thoroughly. “Now, the category is fighting the perception of being overly processed,” said Balanko.

The non-GMO market is growing and is expected to reach $4 billion by 2027. Consumers, particularly younger generations, see GMOs as a solution for feeding growing populations. Yet, Boomers and Gen X “still carry much baggage from the 1990s and the initial introduction of GMOs,” explained Balanko. Even though younger generations are more open to GMOs, they’re “concerned about GMOs’ impact on long-term biodiversity and (whether) corporations are owning life,” she added.

The size of the global cell-cultured meat market is projected to reach $319.8 million by 2028. Consumers are most skeptical of cell-cultured foods, although this varies by category. “When it comes to barriers, it’s the ‘ick’ factor,” said Balanko. Educating consumers will seemingly be the best way to break some of their barriers to this technology. “It will take a little time for our culture to overcome [the barriers].”

You can bend culture, but if you push it too hard, too fast, you can break [it], which means your products will fail,” Balanko said. “Consumers want to know that technology isn’t being brought to market just for the sake of it…the consumer is at the helm. That behooves us to understand what they think; what they need; and how they feel,” she concluded.

Caption to chart “Attitudes toward Agriculture, Science Technology and Food”: The statistically significant increases in the “Progress through Science/Tech” portion of this chart demonstrate that science and technology are gaining traction among consumers who want healthier, more sustainable foods. Consumers question whether returning to traditional, “natural” production methods is viable.

Caption to the futuristic greenhouse feature photo: Younger generations see GMOs as a solution for feeding growing populations. However, they’re “concerned about GMOs’ impact on long-term biodiversity and (whether) corporations are owning life,” said Shelley Balanko.

Click on the phrases below to see related articles on these topics at FoodTrendsNTech.com.