Research on protein products, consumers and flavor titled “Consumers and the Protein Product Explosion: Flavor Still Rules,” was presented by MaryAnne Drake, Director of the Sensory Service Center at North Carolina State University. at the 2022 Protein Trends & Technologies Seminar.

There has been a massive rise in the purchase and consumption of plant-based alternatives and, at the same time, the consumption of dairy products is at an all-time high—one not seen since the 1950s, noted Drake. Additionally, plant-based protein sources have exploded, and animal-free or precision-fermentation protein products have recently appeared on the market. Both types imply a sustainable, ethical or healthy alternative.

Drake’s group surveys consumer insights on protein choices. In 2018, consumer focus was on the total amount of protein per serving, with a clear preference for whey protein over plant protein. In 2020, consumers expressed interest in “good source, “complete protein” and “flavor” and found plant-based protein more desirable than dairy protein.

In an August 2022 survey, key protein attributes investigated were “good source of protein,” “tastes great,” “healthy” and “complete protein.” The type of protein, plant vs. dairy, decreased slightly in importance.

Sustainability Growth

Although dairy protein still leads the market, pressure for sustainability continues to build. Yet, there needs to be more consumer knowledge. For example, agriculture contributes only 10% to U.S. greenhouse emissions, but consumers think it contributes 24%.

The CFR defines sustainability, but it is a very gray area for consumers. Packaging, animal welfare, environmental impacts and simple/minimal ingredients all affect the perception of sustainability. Plant sources are universally perceived as more sustainable than animal. Soy/pea is perceived as more sustainable than almond, coconut or dairy. Drake said plant protein powders are considered more sustainable than almond or dairy.

Interest in food sustainability is strong among Millennials and Gen Zs, while older consumers have a better understanding of dairy products and proteins. Most consumers need to gain more knowledge of animal-free protein. “Precision fermentation” or “cell-cultured” are more favorable terms than “animal-free” or “gene-edited,” Drake explained.

Some consumers believe that “good source of protein” is a marketing term. They also don’t know what “complete protein” means. However, complete protein is a valuable indicator for dairy protein once consumers are educated on the definition. Adding a processing term, such as pasteurized or ultrafiltered, decreases consumer confidence. Even adding the word “concentrate” or “isolate” to a pea protein makes consumers think it is less natural. Drake advised that we can positively influence consumers with a small amount of information.

Protein Flavor

All proteins have flavor, and off-flavors are present in all protein types. Within a given protein type, there is much variability in flavor. Additionally, protein flavor changes over time. Generally, the more protein you put into a product, the more issues you will have with protein flavor.

In one study, a trained panel in Drake’s lab tasted 10 samples of whey protein from different protein suppliers and found they all tasted different. The same was true for pea proteins. The panel also found that soy, milk, whey, potato and pea protein had a unique flavor profile.

Plant proteins have a wider array of flavors; some are easier to mask than others. As one increases the amount of protein, the intensity of flavors increases. In comparison, protein beverages made with blander whey proteins were preferred by consumers. When ready-to-mix (RTM) protein powders were rehydrated, the “liking” of those made with plant proteins was not equivalent to the liking of those made with dairy protein. Using principal component analysis and projective mapping, plant-based yogurts didn’t taste anything like dairy yogurt. Similar results were found with plant-based cream cheese and other plant-based cheeses.

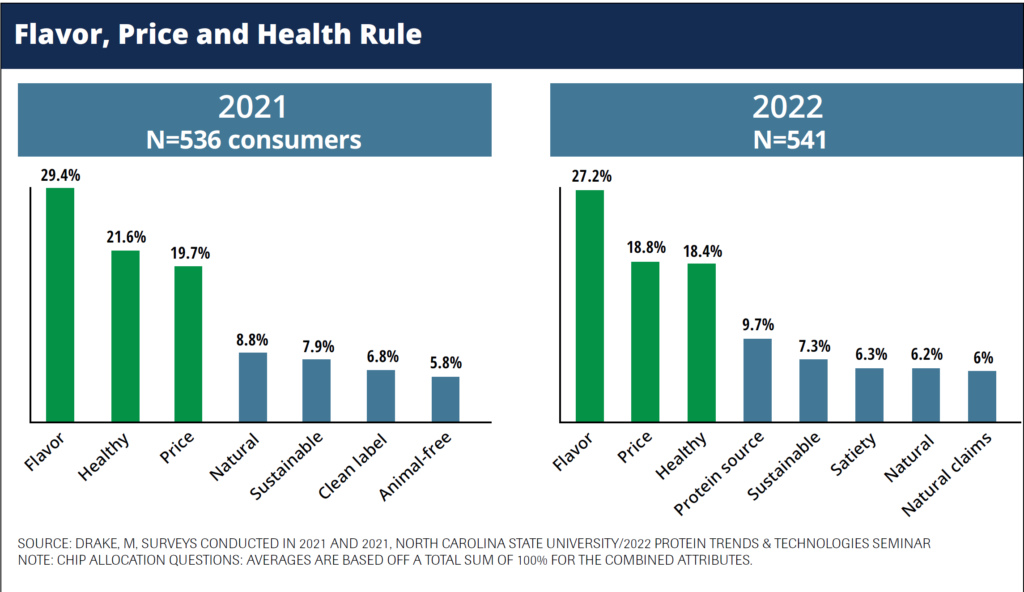

While flavor rules, texture and functionality are also critical for consumer experience. Texture is challenging for plant-based cheese, as is smoothness, melt and heat stability. (See chart “Flavor, Price and Health Rule.”)

For plant proteins, the opportunities include consumer desire for more plant-based products and increased pressure for sustainability. The challenges include issues with flavor, texture and consumer perception. Dairy’s opportunities include great taste and nutrition, plus a clean label. Many consumers are uneducated about the health benefits of dairy, including that it is a complete protein. Consumers are also misinformed about sustainable agriculture and the dairy industry.

“Consumers and the Protein Product Explosion: Flavor Still Rules,” MaryAnne Drake, Ph.D., Sensory Analysis and Flavor Chemistry, William Neal Reynolds Distinguished Professor, North Carolina State University.

Caption to chart: A 2022 survey found that “flavor” is still the most important attribute for consumers, and “price” came in second place. In the 2021 survey, “healthy” occupied second place.

Click on the phrases below to see related articles on these topics at FoodTrendsNTech.com.